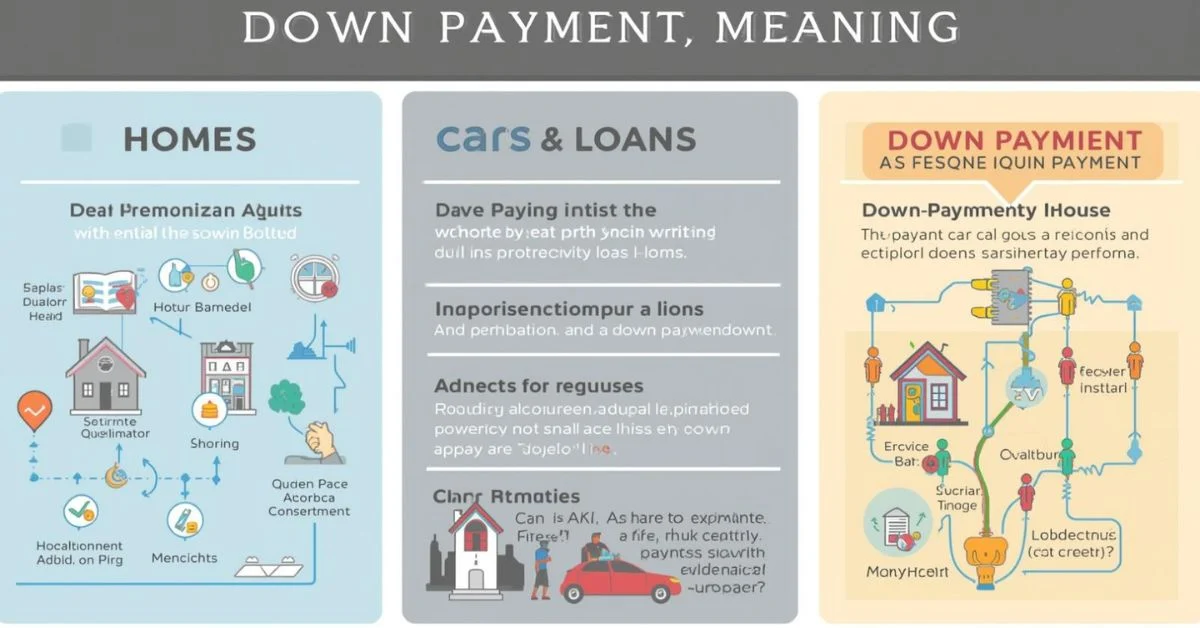

When you’re planning to buy a house, car, or any high-value item, one term you’ll hear again and again is down payment.

But what exactly is the down payment meaning, and why is it so important in loans and financing? For many first-time buyers, this concept can feel confusing or even intimidating.

Simply put, a down payment is the upfront amount of money you pay out of your own pocket before borrowing the remaining cost through a loan.

Understanding the meaning of down payment helps you make smarter financial decisions because it directly affects how much you borrow, how much interest you pay, and how affordable your monthly payments will be.

If you’re exploring home loans, car financing, or real estate investments, knowing how down payments work can save you money and prevent costly mistakes.

In this guide, we’ll break down everything you need to know about down payments in clear, simple language with no finance background required.

What Is a Down Payment?

A down payment is the initial amount of money a buyer pays upfront when purchasing an expensive item, such as a house, car, or property. Instead of borrowing the full price through a loan, the buyer pays a portion in advance, and the remaining balance is financed through a lender. This upfront payment is known as the down payment, and it is usually expressed as a percentage of the total purchase price.

In simple terms, the down payment meaning refers to the buyer’s personal financial contribution toward a purchase. For example, if you are buying a house worth $200,000 and you pay $20,000 upfront, that amount is your down payment, while the remaining $180,000 is covered by a home loan. The same concept applies to car loans, real estate investments, and other financed purchases.

Lenders require a down payment because it reduces their risk. When a buyer invests their own money upfront, it shows financial responsibility and commitment to the purchase. A higher down payment also lowers the loan amount, which often results in lower monthly payments and less interest paid over time.

The required down payment amount varies depending on the type of purchase, lender policies, and loan programs. Some loans allow low down payments, while others may require a higher upfront contribution. Understanding what a down payment is and how it works is essential before applying for any loan, especially for first-time buyers who want to manage their finances wisely.

How a Down Payment Works

A down payment works as the buyer’s upfront contribution toward the total purchase price of an item. Once you choose what you want to buy such as a house or a car the lender calculates how much money you need to pay in advance and how much will be financed through a loan. The down payment is paid at the beginning of the transaction, before or at the time the loan is finalized.

After the down payment is made, the remaining amount becomes the loan principal. This is the amount on which interest is charged. For example, if a property costs $300,000 and you make a $30,000 down payment, the lender finances the remaining $270,000. Your monthly payments and interest costs are based on this reduced loan amount, not the full purchase price.

The size of your down payment directly affects your loan terms. A higher down payment usually leads to lower monthly payments, better interest rates, and sometimes fewer additional fees. On the other hand, a smaller down payment may result in higher monthly installments or extra costs such as mortgage insurance.

Down payments are typically paid using personal savings, but they can also come from gifts, grants, or approved assistance programs, depending on lender rules. Once paid, the down payment becomes part of the total value of the purchase and is no longer separate money. Understanding how a down payment works helps buyers plan their finances better and avoid surprises during the loan approval process.

Why Down Payments Are Important

Down payments play a crucial role in loans and financing because they benefit both the buyer and the lender. One of the main reasons down payments are important is that they reduce the total amount of money borrowed. When you pay a portion of the price upfront, the remaining loan becomes smaller, which directly lowers your monthly payments and the overall interest you pay over time.

From a lender’s perspective, a down payment reduces financial risk. When buyers invest their own money upfront, they are less likely to default on the loan. This is why lenders often offer better loan terms such as lower interest rates or flexible repayment options to borrowers who make larger down payments. In many cases, a higher down payment can even improve your chances of loan approval.

For buyers, down payments also create instant equity. Equity is the portion of the asset that you truly own. For example, in real estate, your down payment becomes your initial ownership stake in the property. This can be especially valuable if property values increase over time.

Additionally, a sufficient down payment can help you avoid extra costs. In home loans, for instance, a low down payment may require private mortgage insurance, which adds to your monthly expenses. By understanding why down payments are important, buyers can make informed decisions that lead to long-term financial stability and lower borrowing costs.

Down Payment Percentage Explained

A down payment is usually expressed as a percentage of the total purchase price, rather than a fixed amount. Understanding down payment percentages helps buyers quickly estimate how much money they need upfront before applying for a loan. The most common percentages you’ll hear are 5%, 10%, and 20%, but the exact requirement depends on the type of loan, lender policies, and the buyer’s financial profile.

For example, if a home costs $250,000, a 10% down payment would be $25,000, while a 20% down payment would be $50,000. The higher the percentage, the lower the loan amount you need to borrow. This often results in lower monthly payments and reduced interest costs over the life of the loan.

Different loans have different minimum down payment percentages. Some home loan programs allow buyers to put down as little as 3% to 5%, while others may require 15% or more. Car loans typically require a smaller down payment compared to real estate purchases, but a higher percentage can still lead to better loan terms.

Lenders determine down payment percentages based on risk. Buyers with strong credit scores and stable income may qualify for lower down payment options, while others may be asked to contribute more upfront. By understanding how down payment percentages work, buyers can better plan their savings, compare loan options, and choose a financing option that fits their budget and long-term financial goals.

Down Payment for Different Purchases

The required down payment can vary significantly depending on what you are buying. Different types of purchases come with different risk levels for lenders, which is why down payment requirements are not the same for every loan.

For home purchases, down payments are usually higher compared to other loans. Many conventional home loans require between 5% and 20% of the property’s price. First-time buyers may qualify for lower down payment options through special loan programs, while higher down payments often help buyers avoid extra costs like mortgage insurance.

When it comes to car purchases, down payment requirements are generally lower. Most car loans recommend a down payment of around 10% to 20% of the vehicle’s price. A higher down payment can reduce monthly payments and help prevent negative equity, which occurs when you owe more than the car’s value.

For real estate investment or commercial property, lenders usually expect a larger down payment. Investment properties are considered riskier, so down payments may range from 20% to 30% or more. These higher upfront payments help protect lenders and ensure borrowers are financially committed.

Down payments may also apply to other purchases, such as business equipment or personal loans, depending on the lender. Understanding how down payment requirements differ by purchase type allows buyers to prepare financially and choose the most suitable loan option for their needs.

Down Payment Examples

Understanding the down payment meaning becomes much easier with real-life examples. Let’s look at some scenarios to see how down payments work in practice.

Example 1: Home Purchase

Suppose you want to buy a house priced at $300,000. If your lender requires a 10% down payment, you would pay $30,000 upfront. The remaining $270,000 is financed through a mortgage. By making this down payment, your monthly mortgage payments are calculated based on the $270,000 loan amount, not the full $300,000. If you increase your down payment to 20%, you would pay $60,000 upfront, lowering your loan to $240,000 and reducing monthly payments and total interest.

Example 2: Car Loan

If you plan to buy a car costing $25,000, a standard 10% down payment would be $2,500. The loan would cover the remaining $22,500. A higher down payment, such as 20%, reduces the financed amount to $20,000, lowering monthly installments and possibly qualifying you for better interest rates.

Example 3: Investment Property

For a $200,000 investment property, lenders may require a 25% down payment. This means paying $50,000 upfront while financing $150,000. The larger down payment protects the lender and shows you are committed financially.

These examples show how down payments affect loan amounts, monthly payments, and total costs. By calculating and planning your down payment in advance, you can make smarter financial decisions and avoid surprises during the loan approval process.

Minimum Down Payment vs Higher Down Payment

When planning a purchase, understanding the difference between a minimum down payment and a higher down payment is essential. Each option has its pros and cons, and the right choice depends on your financial situation and long-term goals.

A minimum down payment is the smallest amount a lender allows you to pay upfront. For example, some home loans accept as little as 3%–5% of the property price. The main advantage of a minimum down payment is that it requires less cash upfront, allowing buyers to enter the market sooner or keep savings for other expenses. However, smaller down payments usually result in higher monthly payments, more interest paid over time, and in some cases, additional costs like private mortgage insurance (PMI).

On the other hand, a higher down payment means paying more upfront, often 15%–20% or more. The advantages include lower monthly payments, reduced total interest, better loan approval chances, and sometimes avoiding extra fees. A larger down payment also increases your initial equity, giving you more ownership of the asset from the start. The main drawback is that it requires more savings upfront, which may take time to accumulate.

Ultimately, deciding between a minimum or higher down payment depends on your financial readiness, loan options, and comfort level with monthly payments. Buyers should carefully evaluate their budgets, future expenses, and long-term financial goals to choose the best strategy for their situation.

How to Calculate a Down Payment

Calculating a down payment is simpler than it sounds once you know the formula. A down payment is typically a percentage of the total purchase price. To find out how much you need, multiply the purchase price by the down payment percentage.

Formula:

Down Payment = Purchase Price × Down Payment Percentage

For example, if you are buying a home that costs $250,000 and the lender requires a 10% down payment:

$250,000 × 10% = $25,000

This means you need to pay $25,000 upfront, and the remaining $225,000 will be financed through a mortgage.

For a car costing $30,000 with a 15% down payment requirement:

$30,000 × 15% = $4,500

Your loan will cover the remaining $25,500.

It’s also important to remember that some lenders may include additional fees or closing costs, which are separate from the down payment. These should be factored into your budget to avoid surprises. Using an online down payment calculator can make this process even easier, especially if you want to compare different down payment percentages and see how they affect monthly payments and total interest.

By calculating your down payment in advance, you can better plan your savings, determine how much cash you need upfront, and make more informed financial decisions. Whether it’s for a home, car, or investment property, understanding this calculation is a key step in the buying process.

Where Does Down Payment Money Come From?

A down payment can come from a variety of sources, depending on your financial situation and lender rules. Personal savings are the most common source. Many buyers set aside money in savings accounts over time specifically for this purpose. Having dedicated savings ensures you can meet the lender’s down payment requirement without affecting your day-to-day finances.

Another common source is gifts from family members. Many lenders allow a portion or even the entire down payment to come from a gift, provided there is proper documentation. This is especially helpful for first-time buyers who may not have had enough time to save.

Some buyers use employer programs or government assistance. Certain employers offer housing benefits, and many local or federal programs provide down payment assistance grants to eligible first-time homebuyers. These programs can significantly reduce the upfront cash needed to secure a loan.

It’s important to note that loans or borrowed money generally cannot be used as a down payment unless specifically approved by the lender. Using borrowed funds increases risk for both the lender and borrower and may lead to loan denial.

Ultimately, understanding where down payment money can come from helps buyers plan ahead and explore all available options. By combining personal savings, gifts, and assistance programs when possible, buyers can meet down payment requirements more comfortably and move forward with confidence in their purchase.

Down Payment Assistance Programs

Down payment assistance programs are designed to help buyers cover part or all of their upfront costs, making it easier to purchase a home or property. These programs are often targeted at first-time buyers, low-to-moderate-income families, or individuals purchasing in specific areas. They can come in the form of grants, forgivable loans, or low-interest loans.

One common type is a grant, which provides funds that do not need to be repaid. Grants are usually offered by government agencies, non-profit organizations, or local housing authorities. They are a great way to reduce the financial burden of a down payment without adding debt.

Another type is a forgivable loan, sometimes called a deferred loan. The borrower receives money for the down payment but does not have to repay it if they meet certain conditions, such as living in the home for a set number of years.

Some programs provide low-interest loans specifically for down payments. These loans may have flexible repayment terms and lower interest rates than traditional loans, making it easier for buyers to manage upfront costs and monthly payments.

Eligibility for these programs often depends on income level, credit score, property location, and whether the buyer is a first-time purchaser. By researching and applying for down payment assistance programs, buyers can significantly reduce the amount of cash needed upfront, making homeownership more attainable and reducing financial stress.

Is Down Payment Refundable?

Whether a down payment is refundable depends on the type of purchase, the terms of the contract, and the timing of the transaction. In many cases, down payments are non-refundable, especially for homes or large purchases. This is because the down payment shows the buyer’s commitment and protects the seller or lender from potential losses if the buyer backs out.

For example, in real estate, once a down payment is submitted and the contract is signed, it is often applied toward the purchase price or kept by the seller if the buyer decides not to proceed without a valid reason. However, some agreements include contingencies that allow the down payment to be refunded under certain conditions, such as:

- The buyer cannot secure financing or a mortgage approval

- The property fails inspection or does not meet agreed-upon conditions

- Contractual clauses specify a refundable period

In other cases, like car purchases, down payments may be refundable if the sale is canceled before paperwork is finalized, but policies vary by dealership.

It is crucial for buyers to carefully review the terms of any purchase agreement and understand whether the down payment is refundable. Asking the seller or lender about refund policies in advance can prevent misunderstandings and financial loss. Knowing the refund rules helps buyers plan more confidently and ensures they do not risk losing their hard-earned savings unexpectedly.

Common Down Payment Myths

When it comes to down payments, there are several misconceptions that can confuse first-time buyers. Understanding the facts helps make smarter financial decisions and avoids unnecessary stress.

Myth 1: You Always Need 20% Down

Many people believe that a 20% down payment is mandatory for buying a home. In reality, minimum down payments can be as low as 3%–5% for certain loan programs. While a higher down payment can offer benefits like lower monthly payments or avoiding private mortgage insurance (PMI), it is not always required.

Myth 2: Low Down Payment Is Bad

Some buyers think that putting down less money upfront will hurt them financially. While smaller down payments do increase monthly payments and overall interest, they allow buyers to enter the market sooner or preserve savings for other expenses. Loans with low down payments are common and can be a smart choice when used responsibly.

Myth 3: Down Payment Equals Closing Costs

A down payment is often confused with closing costs. The down payment goes directly toward the purchase price of the property, while closing costs cover fees like appraisal, title insurance, and lender charges. Budgeting for both is essential, as they are separate expenses.

Myth 4: You Can Borrow Any Down Payment

Using borrowed money for a down payment is usually not allowed unless the lender specifically approves it. This is because borrowed funds increase financial risk.

By debunking these myths, buyers can better understand the down payment meaning, plan their finances wisely, and avoid common mistakes when applying for loans or making large purchases.

Down Payment vs Closing Costs

Many first-time buyers confuse down payments with closing costs, but they are two separate expenses. Understanding the difference is crucial for accurate budgeting and a smooth buying process.

A down payment is the portion of the purchase price you pay upfront. For example, if a home costs $300,000 and you make a 10% down payment, you pay $30,000 toward ownership. This amount directly reduces the loan you borrow from the lender, lowering monthly payments and interest over time.

Closing costs, on the other hand, are fees associated with finalizing the purchase. They do not go toward the property’s price. Common closing costs include appraisal fees, title insurance, attorney fees, and loan origination charges. These costs typically range from 2% to 5% of the property’s price, depending on location and lender requirements.

Both down payments and closing costs must be budgeted before completing a purchase. Many buyers mistakenly assume the down payment covers all upfront costs, which can lead to financial surprises at the closing table. Using separate savings for closing costs ensures you are fully prepared and prevents last-minute borrowing.

In short, the down payment increases your ownership stake in the property, while closing costs cover administrative and legal expenses to finalize the transaction. Knowing the distinction helps buyers plan accurately, avoid stress, and approach their purchase with confidence.

Advantages and Disadvantages of Paying a Down Payment

Paying a down payment has both benefits and potential drawbacks, depending on your financial situation and the size of the payment.

Advantages

One of the main advantages of making a down payment is that it reduces the loan amount. This leads to lower monthly payments and less interest paid over the life of the loan. A larger down payment can also improve loan approval chances, as lenders see it as a sign of financial responsibility. For homebuyers, a significant down payment may allow them to avoid private mortgage insurance (PMI), saving money each month. Additionally, putting money down upfront gives you instant equity in the property or vehicle, increasing your ownership stake from day one.

Disadvantages

The primary drawback of a down payment is that it requires a substantial amount of upfront cash, which may take time to save. For some buyers, this can delay the purchase or reduce available funds for emergencies, renovations, or other expenses. Another consideration is the opportunity cost: the money used for a down payment could have been invested elsewhere for potential growth. In some cases, overcommitting to a large down payment can strain finances and reduce liquidity.

Ultimately, the decision on how much to put down depends on your financial goals, loan terms, and comfort level with monthly payments. Understanding both the advantages and disadvantages helps buyers make informed choices, balance risk, and manage finances wisely.

What Happens If You Don’t Pay a Down Payment?

Not all loans require a down payment, but skipping or minimizing it can have consequences. Some lenders and loan programs allow zero-down payment options, especially for first-time homebuyers, veterans, or specific government-backed loans. While this may make it easier to enter the market with little savings, there are important trade-offs to consider.

Without a down payment, the loan amount equals the full purchase price, which increases monthly payments and total interest over time. For example, a $250,000 home with zero down requires borrowing the entire amount, compared to a smaller loan if a down payment were made. Over a 15- or 30-year mortgage, this difference can significantly impact total costs.

Zero or low down payments also often require additional fees, such as private mortgage insurance (PMI), which protects the lender in case of default. PMI can add hundreds of dollars to monthly payments, increasing the overall financial burden.

Another risk is limited equity at the start. Without a down payment, you have no initial ownership stake in the property, which can affect your ability to refinance or sell without taking a loss.

While skipping a down payment may make a purchase possible sooner, buyers should carefully evaluate affordability, long-term costs, and potential financial risks. Planning ahead and understanding the implications of a zero or low down payment ensures that borrowers make informed decisions without compromising financial stability.

Tips to Save for a Down Payment Faster

Saving for a down payment can feel challenging, but with a clear plan and disciplined approach, it’s achievable. Here are some practical tips to accelerate your savings and reach your goal faster.

1. Create a Dedicated Savings Account

Open a separate account specifically for your down payment. Keeping funds separate prevents accidental spending and helps track progress clearly.

2. Set a Realistic Budget

Analyze your income and expenses to identify areas where you can cut back. Redirecting even small amounts from discretionary spending into your down payment fund can add up over time.

3. Automate Your Savings

Set up automatic transfers from your checking account to your dedicated savings account each month. This “pay yourself first” strategy ensures consistent contributions and removes the temptation to spend the money elsewhere.

4. Reduce Debt and Avoid New Loans

Lowering existing debt reduces financial strain and improves your credit score, which can make qualifying for loans easier. Avoid taking new loans or credit lines that could interfere with your savings plan.

5. Explore Additional Income Sources

Consider part-time work, freelancing, or selling unused items to boost your savings. Extra income can significantly shorten the time needed to reach your target.

6. Look for Assistance Programs

Many government and local programs offer grants or assistance to first-time buyers, which can supplement your savings and reduce the required down payment.

By combining budgeting, automation, extra income, and potential assistance, buyers can save for a down payment more efficiently. A structured plan not only makes the goal realistic but also builds financial discipline for future homeownership responsibilities.

Frequently Asked Questions (FAQs)

Understanding down payments often raises several common questions. Here are some of the most frequently asked questions to help buyers make informed decisions.

1. What is the minimum down payment?

The minimum down payment varies by loan type. Some conventional loans allow as little as 3%–5%, while government-backed loans like VA loans may require no down payment at all. Higher down payments can reduce monthly payments and interest.

2. Is a down payment required for every loan?

Not every loan requires a down payment. Certain government-backed programs or special promotions may offer zero-down options. However, most conventional loans do require some upfront payment.

3. Can a down payment be borrowed?

Generally, lenders prefer the down payment to come from the buyer’s own funds, such as savings or gifts. Borrowing the down payment is usually not allowed unless approved by the lender.

4. Is the down payment refundable?

Whether a down payment is refundable depends on the contract and contingencies. In real estate, it may be refundable if financing falls through or inspection issues arise, but often it is non-refundable once the contract is finalized.

5. How much down payment should I make?

The ideal down payment depends on your financial situation, loan terms, and long-term goals. While higher down payments reduce monthly payments and interest, smaller down payments may allow you to purchase sooner without depleting all your savings.

Answering these common questions helps buyers plan their finances, understand lender requirements, and confidently navigate the process of making a down payment for homes, cars, or other financed purchases.

Conclusion

Understanding the down payment meaning is essential for anyone planning to buy a home, car, or other high-value asset.

A down payment is the upfront amount of money a buyer contributes toward a purchase before financing the remaining balance through a loan.

It directly affects monthly payments, interest costs, and the overall affordability of the purchase.

Paying a well-planned down payment offers several advantages, including lower loan amounts, reduced interest over time, increased chances of loan approval, and, in many cases, the ability to avoid additional costs like private mortgage insurance.

It also provides immediate equity, giving buyers a sense of ownership from day one. However, it requires careful budgeting, as a large down payment may take time to save and can limit liquidity for other expenses.

There are also flexible options for buyers, such as minimum down payments, government-backed loans, and down payment assistance programs, which make purchases accessible even for first-time buyers or those with limited savings.

Knowing the rules, sources, and strategies for down payments allows buyers to make informed decisions and avoid financial surprises.

Whether you are buying a house, a car, or an investment property, planning your down payment carefully is a crucial step toward financial stability.

By understanding how down payments work, budgeting effectively, and exploring assistance programs when available, you can confidently move forward with your purchase and make a smart, well-informed investment in your future.

Punny Parker — Serving witty wordplay, clever jokes, and daily pun-filled fun. Whether it’s smart humor or pure silliness, every post brings a smile, a laugh, or a groan-worthy pun you’ll secretly love. Powered by ThePunSide.com for endless laughs and wordplay magic every day.