Pet Insurance Cover , Owning a pet is one of life’s greatest joys but it can also come with unexpected veterinary bills. From sudden accidents to chronic illnesses, the cost of keeping your furry friend healthy can quickly add up. That’s where pet insurance comes in.

But many pet owners ask: what does pet insurance cover exactly? Understanding your policy is crucial to making informed decisions and avoiding surprises when your pet needs care the most.

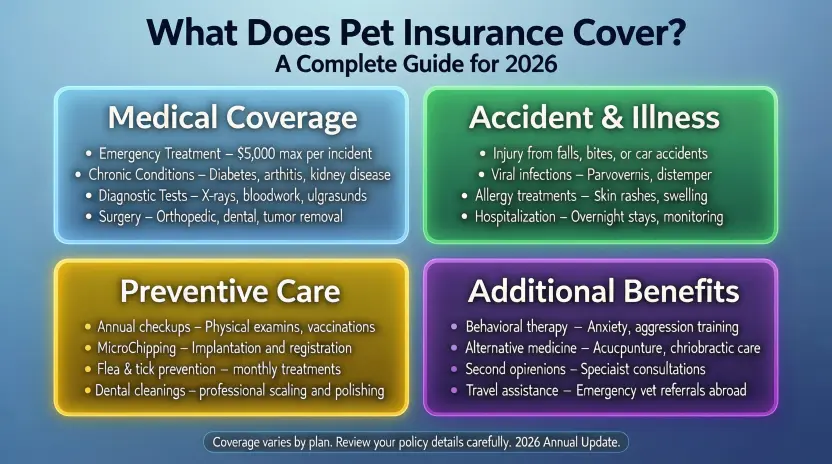

Pet insurance typically covers accidents, illnesses, and sometimes preventive care, but coverage can vary widely depending on the provider and plan.

Some policies even include dental care, hereditary conditions, and alternative therapies, while others focus strictly on emergencies.

In this guide, we’ll explore every aspect of pet insurance coverage, helping you navigate the options and find the plan that keeps your pet safe, healthy, and happy without breaking the bank.

Accidents and Emergency Care

Accidents happen when you least expect them, and having pet insurance can be a real lifesaver. Most comprehensive pet insurance plans cover injuries from accidents, such as broken bones, cuts, burns, or ingestion of foreign objects. If your pet swallows something they shouldn’t or gets hurt while playing outside, insurance can help cover emergency vet visits, hospitalization, and even surgery costs.

Emergency care coverage typically includes 24/7 vet visits, diagnostic tests like X-rays or bloodwork, and the cost of surgical procedures if necessary. Some plans also cover post-surgery medications and follow-up treatments, ensuring your pet recovers fully without putting you in financial stress.

It’s important to note that coverage can vary between insurers. Some may cover accidents only, while others include both accidents and illnesses. Policies may also have deductibles and co-pays, so understanding your plan’s terms is essential before a crisis arises.

Real-life examples show how valuable accident coverage can be: a dog who fractured a leg while running in the park or a cat who swallowed a small toy could cost thousands in emergency care. With the right pet insurance, most of these expenses are reimbursed, giving both you and your pet peace of mind.

Accidents are unpredictable, but with proper coverage, you can make sure your furry friend gets quick and effective treatment whenever it’s needed.

Illnesses and Medical Conditions

While accidents are sudden and unpredictable, illnesses can develop gradually and still lead to significant veterinary expenses. Most comprehensive pet insurance policies cover a wide range of medical conditions, from minor infections to chronic diseases. Commonly covered illnesses include ear infections, urinary tract infections, skin allergies, and gastrointestinal issues, as well as more serious conditions like diabetes, kidney disease, or cancer.

Pet insurance typically reimburses costs for diagnostic tests (bloodwork, X-rays, ultrasounds), medications, and treatments prescribed by your veterinarian. Chronic conditions that require ongoing care, such as diabetes or thyroid disorders, are often covered, but coverage may vary depending on the insurer. It’s essential to check whether your policy distinguishes between acute conditions (sudden onset) and chronic conditions (long-term management).

Some policies also include coverage for specialist consultations and surgeries required to treat severe illnesses. However, pre-existing conditions that appeared before your pet was insured are usually excluded. Understanding these exclusions can prevent surprises when filing a claim.

Real-world examples highlight the value of illness coverage: a dog diagnosed with cancer may require surgery, chemotherapy, and medications totaling thousands of dollars. With pet insurance, many of these costs can be reimbursed, allowing you to focus on your pet’s health instead of worrying about bills.

Pet insurance for illnesses ensures your pet gets timely and proper treatment, helping them live a longer, healthier, and happier life.

Preventive Care and Wellness Plans (Optional Add-Ons)

While accidents and illnesses are often covered under standard pet insurance plans, many pet owners want coverage for preventive care to keep their pets healthy before problems arise. Preventive care or wellness plans are usually offered as optional add-ons, helping cover routine services like annual check-ups, vaccinations, and booster shots. These plans can also include flea, tick, and heartworm prevention, which are essential for long-term pet health.

Dental cleanings are another common preventive service that some insurers cover under wellness plans. Maintaining oral health can prevent serious complications such as infections or tooth loss, which might otherwise lead to costly emergency treatments. Some policies even reimburse nutritional consultations, microchipping, or spay/neuter procedures.

Wellness plans differ from standard accident and illness coverage because they focus on preventive maintenance rather than emergency care. They are ideal for pet owners who want a proactive approach, ensuring regular check-ups and early detection of potential issues.

It’s important to note that preventive coverage often has annual limits or caps, and not all wellness expenses may be fully reimbursed. Reading the policy details carefully helps you understand what’s included and what requires out-of-pocket payment.

By combining preventive care coverage with traditional pet insurance, you can reduce the risk of serious health problems and avoid unexpected veterinary bills. In the long run, wellness plans help keep your pet happy, healthy, and thriving.

Dental Coverage

Dental health is often overlooked, but it is a crucial part of your pet’s overall well-being. Many pets suffer from dental issues such as gum disease, tooth decay, or infections, which can lead to pain, difficulty eating, and even systemic health problems if left untreated. Some pet insurance plans include dental coverage either as part of a comprehensive plan or as an optional add-on.

Covered dental care typically includes treatment for infections, extractions, and emergency dental procedures. If your pet fractures a tooth or develops a painful abscess, insurance can help cover the costs of procedures and medications required for recovery. However, it’s important to know that cosmetic procedures like teeth whitening or orthodontics are generally not covered.

Dental coverage may also include preventive cleanings, but these often have annual limits or require a separate wellness plan. Some insurers only reimburse dental treatments performed due to accidents or illness, so checking the policy details is essential to avoid surprises.

Real-world examples show the value of dental insurance: a dog with a severe tooth infection might need multiple extractions and medications, which can cost hundreds or even thousands of dollars. With coverage, most of these expenses can be reimbursed, saving you money and protecting your pet’s health.

Investing in dental coverage ensures your pet maintains healthy teeth and gums, preventing painful conditions and improving overall quality of life. Regular dental care combined with insurance can help your pet live a longer, happier life.

Prescription Medications

Prescription medications are a critical part of maintaining your pet’s health, whether for treating illnesses, managing chronic conditions, or post-surgery recovery. Many pet insurance plans cover medications prescribed by a licensed veterinarian, helping reduce the financial burden of ongoing treatments. This can include antibiotics for infections, pain relievers after surgery, or medications for conditions like diabetes, thyroid disorders, or heart disease.

Coverage for prescription drugs typically varies depending on the type of insurance plan. Comprehensive plans often reimburse a percentage of the cost of prescribed medications, while some wellness or add-on plans may cover preventive medications, such as flea, tick, or heartworm prevention. It’s essential to check whether your policy requires generic medications, as some insurers may limit coverage to lower-cost alternatives.

However, there are some exclusions to be aware of. Over-the-counter medications, supplements, and vitamins are usually not covered, and some plans may have limits on chronic medication reimbursements. Additionally, pre-existing conditions may affect whether your pet’s ongoing prescriptions are eligible for coverage.

Having prescription medication coverage is especially valuable for pets with long-term illnesses or post-operative care needs. For example, a dog diagnosed with diabetes may require daily insulin, and a cat recovering from surgery might need multiple medications over several weeks. With insurance, the cost of these necessary medications is often partially or fully reimbursed, ensuring your pet receives timely treatment without breaking your budget.

Hereditary and Congenital Conditions

Some pets are prone to hereditary or congenital health issues they are born with or that run in their breed. Examples include hip dysplasia in large dogs, heart defects in certain cat breeds, and spinal problems in small dog breeds. Treating these conditions can be expensive, often requiring surgery, ongoing medications, or specialized care.

Many pet insurance plans offer coverage for hereditary and congenital conditions, but it depends on the insurer and the plan. Comprehensive plans typically include these conditions, whereas more basic or accident-only policies might not. It’s essential to read the fine print, as coverage may vary by breed, age, or whether the condition appears after the pet is insured.

Pre-existing conditions issues that existed before the policy start date are generally excluded, but hereditary or congenital conditions that appear after coverage begins are often covered. Some insurers also offer optional add-ons or higher-tier plans specifically designed to include breed-specific conditions, ensuring your pet gets the care they need without extreme out-of-pocket costs.

For example, a German Shepherd with hip dysplasia may require surgery and physiotherapy. With proper coverage, most of these expenses are reimbursed, allowing owners to provide the best care without financial stress. Understanding hereditary and congenital coverage ensures your pet receives preventive monitoring, early treatment, and long-term care, helping them live a healthier, happier life.

Alternative and Complementary Therapies

In addition to traditional veterinary care, many pet owners turn to alternative and complementary therapies to improve their pet’s health and recovery. These treatments can include physical therapy, hydrotherapy, acupuncture, chiropractic care, massage, and behavioral therapy. While not all insurers automatically cover these therapies, some comprehensive or optional add-on plans do provide partial reimbursement.

Physical therapy and rehabilitation are commonly covered when prescribed to treat an injury, post-surgery recovery, or mobility issues caused by conditions like arthritis. Hydrotherapy, for example, can help dogs regain strength after orthopedic surgery, while acupuncture may alleviate pain in pets with chronic conditions. Coverage often requires a veterinarian’s prescription or referral, ensuring the therapy is medically necessary rather than purely cosmetic.

Behavioral therapy, such as training for anxiety or aggression, is less commonly covered, but some specialized plans do include it. Pet insurance providers typically set limits on these therapies, including maximum reimbursement per session or annual caps, so reviewing policy terms is essential.

Alternative therapies can be a significant investment, but insurance coverage allows pets to access treatments that improve quality of life, reduce pain, and accelerate recovery. For pets recovering from surgery or managing chronic conditions, having insurance that covers these therapies ensures owners can provide the best care without financial stress.

By including alternative and complementary therapies in your coverage, you can offer a holistic approach to your pet’s health, supporting both physical and emotional well-being.

Travel and Boarding Emergencies

Pets aren’t just part of the family, they often travel with us. Whether it’s a road trip, vacation, or boarding while you’re away, unexpected emergencies can happen at any time. Some pet insurance plans provide coverage for travel-related incidents and boarding emergencies, giving pet owners peace of mind while away from home.

Travel coverage may include accidents or illnesses that occur while your pet is traveling, whether domestically or internationally. For example, if your dog injures itself in a hotel or your cat becomes ill at a boarding facility, insurance can reimburse veterinary costs. Some policies also cover emergency transportation, such as ambulance services or flights to specialized veterinary centers in severe cases.

Boarding facilities can sometimes lead to illness or injury, especially if your pet is exposed to contagious diseases or has an accident in unfamiliar surroundings.

Insurance coverage can help manage these costs, which can otherwise be significant. However, it’s important to check the policy details, as some insurers have restrictions on boarding coverage or only reimburse emergencies, not routine care.

Having travel and boarding coverage ensures your pet can receive timely medical attention anywhere, reducing stress for both pets and owners.

Whether you’re going on vacation or leaving your pet in a trusted boarding facility, this coverage adds an extra layer of protection, ensuring your furry friend is cared for in unexpected situations.

Exclusions and Limitations

While pet insurance can significantly reduce veterinary expenses, it’s important to understand that not everything is covered.

Every policy comes with exclusions and limitations that define what the insurer will not reimburse. Being aware of these details can prevent unexpected out-of-pocket costs when your pet needs care.

One of the most common exclusions is pre-existing conditions. These are illnesses or injuries that existed before your policy started. Most insurers will not cover treatment for such conditions, so it’s important to enroll your pet while they are still healthy.

Additionally, cosmetic or elective procedures, such as tail docking, ear cropping, or teeth whitening, are almost never covered.

Age restrictions and breed-specific limitations are another factor. Some insurers may limit coverage for senior pets or exclude certain breeds prone to hereditary conditions. Policy caps and reimbursement limits also affect coverage: insurers often set annual or per-condition maximum payouts, which can impact expensive treatments like surgery or cancer therapy.

Certain routine or preventive care may also be excluded unless you purchase a wellness plan add-on.

Examples include vaccinations, flea/tick prevention, and dental cleanings. Understanding these limits ensures that you are prepared for costs that insurance will not cover.

By reading your policy carefully and asking questions before purchasing, you can avoid surprises and ensure your pet receives the best possible care within the coverage limits, keeping both your pet and your budget safe.

How to Choose the Right Pet Insurance Plan

Choosing the right pet insurance plan is essential to ensure your furry friend receives the care they need without causing financial strain. With numerous insurers and policy options available, understanding what to look for can make the decision much easier.

Start by assessing your pet’s age, breed, and health history. Puppies and kittens may benefit from comprehensive plans that cover accidents, illnesses, and preventive care, while older pets might need policies focused on accident and illness coverage only. Certain breeds are prone to hereditary conditions, so ensure the plan covers these potential issues.

Next, compare coverage options, deductibles, and reimbursement rates. Deductibles affect how much you pay out-of-pocket before insurance kicks in, while reimbursement percentages determine how much of a vet bill you’ll recover. Annual and per-condition limits are also critical; higher limits provide better financial protection for expensive treatments.

Consider optional add-ons, such as wellness plans or alternative therapies, if preventive care or complementary treatments are important to you. Additionally, check the insurer’s claims process and customer reviews, as efficient reimbursement can save stress during emergencies.

Finally, evaluate cost versus coverage. The cheapest plan may not provide sufficient protection, while the most expensive plan might include features you don’t need. Choosing a plan tailored to your pet’s specific needs ensures you get the best balance of coverage, affordability, and peace of mind, keeping your pet healthy and happy for years to come.

Claims Process and Reimbursements

Understanding the claims process and reimbursement system is crucial to making the most of your pet insurance policy. While coverage protects your pet, the way insurers handle claims can affect how quickly you get reimbursed for veterinary expenses.

Most insurers require you to pay the vet upfront and then submit a claim for reimbursement. This usually involves filling out a form, providing your pet’s medical records, and including receipts for treatments or medications. Many companies now offer digital claim submissions, making the process faster and more convenient.

Reimbursement rates typically vary by policy and can range from 70% to 90% of eligible expenses. Deductibles either annual or per-incident determine how much you pay before the insurer reimburses the remaining costs. Some plans also have annual or per-condition maximum limits, which can cap the total payout for a particular illness or injury.

Timelines for reimbursements differ between insurers. Many process claims within 10–30 days, but delays can occur if documentation is incomplete. To ensure smooth processing, keep detailed veterinary records, including invoices, prescriptions, and test results.

Understanding the claims process helps you budget effectively and ensures your pet receives timely treatment without unnecessary financial stress.

Knowing what’s required and how reimbursements work also reduces surprises during emergencies, allowing you to focus on your pet’s care rather than worrying about bills.

Cost Considerations

One of the most important factors when choosing pet insurance is the cost. Understanding how premiums, deductibles, and reimbursement rates affect your budget can help you select a plan that provides the best value without compromising coverage.

Premiums are the monthly or annual payments you make to maintain your policy. They vary based on your pet’s age, breed, health status, and location. For example, senior pets or breeds prone to hereditary conditions often have higher premiums due to increased risk. Accident-only plans are generally less expensive than comprehensive plans, which cover illnesses, accidents, and optional wellness services.

Deductibles determine how much you pay out-of-pocket before insurance coverage begins. A higher deductible usually lowers your monthly premium, while a lower deductible increases it. It’s essential to balance upfront costs with potential claims, ensuring you’re prepared for emergencies without overpaying.

Reimbursement rates specify the percentage of covered expenses that the insurer will pay after the deductible. Common rates range from 70% to 90%. Some policies also have annual or per-condition limits, which can affect total payouts for expensive treatments like surgery or cancer care.

Optional add-ons, such as wellness or alternative therapy coverage, may increase your premium but can save money in the long run by covering preventive care.

By carefully evaluating premiums, deductibles, reimbursement rates, and coverage limits, you can choose a policy that fits your financial situation while ensuring your pet receives high-quality care whenever needed.

FAQs

Pet insurance can be complex, so it’s normal to have questions.

are some frequently asked questions to help you better understand coverage and make informed decisions.

1. Can I insure multiple pets under one plan?

Many insurers allow coverage for multiple pets, often offering discounted rates for additional pets. Each pet usually has its own policy, but bundling can save money and simplify management.

2. Does pet insurance cover emergencies outside the country?

Some policies provide coverage for emergencies while traveling, but it depends on the insurer and plan.

check for geographic restrictions and whether pre-approval is required for international treatment.

3. Is pet insurance worth it for older pets?

Yes, but premiums are higher for senior pets due to increased health risks. Policies for older pets may focus on accidents and illnesses, while excluding some hereditary or pre-existing conditions.

4. How long does coverage start after signing up?

Most insurers have a waiting period, typically 14–30 days for accidents and up to 12 months for certain illnesses. This prevents coverage for conditions already present when the policy starts.

5. Are routine check-ups and preventive care covered?

Standard plans usually exclude routine care, but optional wellness or preventive add-ons can cover vaccinations, flea/tick prevention, dental cleanings, and wellness exams.

Understanding the answers to these common questions helps pet owners make better choices about policies, coverage limits, and optional add-ons. By knowing what to expect, you can ensure your pet receives proper care without surprises and make the most out of your insurance plan.

Conclusion

Pet insurance is more than just a financial safety net; it’s a way to ensure your furry friend receives timely and high-quality medical care throughout their life.

From accidents and illnesses to prescription medications, dental care, and alternative therapies, understanding what your policy covers allows you to make informed decisions and avoid unexpected expenses.

While every policy has exclusions and limitations, such as pre-existing conditions or cosmetic procedures, choosing the right plan tailored to your pet’s age, breed, and health needs can maximize coverage and peace of mind.

Optional add-ons like wellness plans or complementary therapies provide additional protection, helping your pet stay healthy and happy in the long term.

Cost considerations, including premiums, deductibles, and reimbursement rates, should also guide your decision.

Balancing affordability with comprehensive coverage ensures you can provide the care your pet deserves without stretching your budget.

Finally, understanding the claims process and reimbursement procedures makes navigating insurance straightforward during emergencies, allowing you to focus on your pet’s recovery rather than financial stress.

In short, pet insurance is an invaluable investment in your pet’s health and well-being.

By selecting the right plan and knowing what it covers, you can confidently provide preventive care, emergency treatment, and ongoing medical support, helping your beloved companion live a longer, healthier, and happier life.

Bella Banter is the voice behind ThePunSide.com, creating clever puns, cute captions, and feel-good humor for everyday moments. With a mix of soft vibes and witty banter, Bella turns simple words into smiles. If you love smart jokes, playful lines, and cozy creative energy, you’re in the right place.